Wealth & Wisdom Coming from Our Mothers and Mentors

- Jun 17, 2025

- 2 min read

Why Moms Are Great Financial Mentors — 8 Powerful Reasons Backed by Facts and Heart

When you think about brilliant financial mentors, names like Robert F. Smith or Tiffany “The Budgetnista” Aliche might come to mind. But look closer to home—specifically, at the one who clipped coupons, budgeted birthday parties, and somehow made magic happen at the end of every month. Yes, moms—those often-unsung heroes of the household economy—might just be the best financial mentors we’ve ever had.

Here are 8 compelling reasons (with some trivia and facts!) why moms deserve the spotlight as financial powerhouses.

They Manage Micro-Economies Daily

Moms routinely juggle grocery budgets, school expenses, and utility bills—often on limited income. According to a 2023 study by MagnifyMoney, 61% of moms are the primary financial decision-makers in their households. That’s no small feat when the average cost of raising a child to age 18 is over $310,000 (USDA).

Trivia: The average mom makes about 35,000 decisions per day, many of them involving money!

They teach Value over Price

Ever hear “We’re not buying that, it’s not worth it”? Moms instinctively teach the concept of value, not just cost. From explaining why generic cereal is just as good as the name brand to encouraging investments in durable shoes over trendy ones, moms shape our understanding of long-term savings.

They Model Financial Resilience

Moms are often the first to demonstrate how to bounce back from financial setbacks, be it a layoff, a car repair emergency, or an unexpected medical bill. Their ability to adapt, pivot, and re-budget in real time is a living lesson in emotional and financial intelligence.

TRIVIA: A survey from Credit Karma revealed that 72% of adults credit their mother for teaching them how to stay financially calm in a crisis.

They Teach Through Real-Life Examples

Moms have a sixth sense for finding deals and stretching a dollar. Whether it’s mastering thrift shopping, cashback apps, or meal planning hacks, they turn frugality into a superpower.

TRIVIA: The “Mom Economy” is a growing influence, moms control over 85% of household purchases, totaling $2.4 trillion in annual U.S. spending.

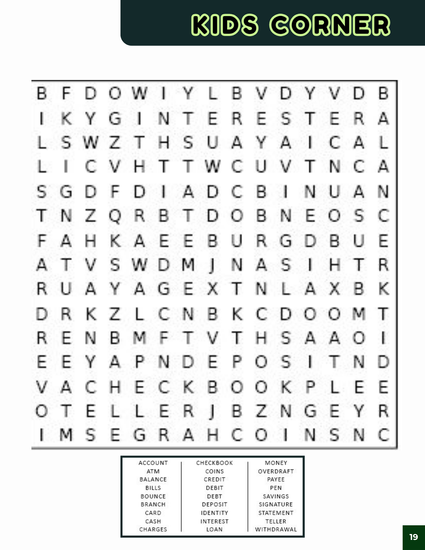

They Make Financial Education Digestible for All Ages

Moms break down financial concepts in simple, relatable terms. Giving a child an allowance? That’s a lesson in budgeting. Taking them school supply shopping with a list and a limit?

Read the full newsletter here ↓

.png)